Since the development of the PCB industry, its application fields involve almost all electronic products, mainly including communications, aerospace, industrial control and medical, consumer electronics, automotive electronics and other industries. The growth of the PCB industry is closely related to the development momentum of the downstream electronic information industry, and the two are mutually reinforcing Promote.

Specifically, network communications, computers and consumer electronics have become the three main application areas of PCB. Thanks to the development of 5G communication technology and the development trend of new energy vehicles and automobile intelligence, automotive electronics has become the fastest growing PCB application area. One of the fields. In the future, with the continued development of the electronic information industry, the application fields of PCB will become more and more extensive.

1. Overview of the main products and PCB product structure in the industry

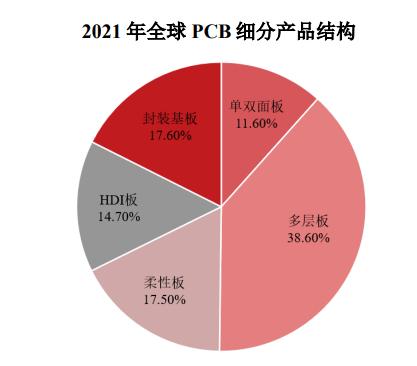

According to the use requirements of different electronic equipment, PCB can be divided into 6 main subdivision products from the perspective of number of layers and technical characteristics: single panel, double panel, conventional multilayer board, flexible board, HDI (High Density Interconnect) board, and IC packaging substrate. .

According to the terminal demand classification of printed circuit boards, it can be divided into enterprise-level user needs and individual consumer needs. Among them, enterprise-level user needs are mainly concentrated in fields such as communication equipment, industrial control, medical care, and aerospace, and related PCB products are often reliable. High performance, long service life, strong traceability and other characteristics, the qualification certification of corresponding PCB companies is more stringent and the certification cycle is longer; individual consumer demand is mainly concentrated in the fields of computers, mobile terminals and consumer electronics, and related PCB products are usually It has the characteristics of thinness, lightness, miniaturization, bendability, etc., and has great demand in terminals.

From a global perspective, according to Prismark data, currently medium- and multi-layer boards still occupy a mainstream position in the PCB market. With the rapid development of technology in the electronic circuit industry, the integration functions of components are becoming increasingly extensive, and the high-density of PCBs in electronic products The requirements are more prominent, and high-end PCB products such as multilayer boards, HDI boards, flexible boards and packaging substrates are gradually occupying a more important position in the market. From the perspective of each subdivided product category, in 2021, the global output value of multilayer boards and HDI boards will be respectively were US$31.053 billion and US$11.811 billion. Among them, the growth rate of multi-layer boards with 8-16 layers was faster, reaching 29.80%, the growth rate of high-level multilayer boards with more than 18 layers was 20.70%, and the growth rate of HDI boards was 19.60%.

Data source: Prismark

Data source: Prismark

From a domestic perspective, although there are still few domestic manufacturers that can produce high-tech products such as multi-layer boards, HDI boards and packaging substrates, the proportion of such products is increasing year by year. In addition, according to Prismark's forecast, in the future The growth rate of the output value of each segment of China's PCB industry is higher than the global average, especially high-tech PCBs represented by high-end multilayer boards, HDI boards, flexible boards and packaging substrates. Taking packaging substrates as an example, in 2016 By 2020, China's packaging substrate output value will have a compound annual growth rate of approximately 5.50 percent, while the global average is only 0.10 percent, and the industry transfer trend is obvious.

2. my country’s PCB industry import and export situation

In recent years, against the background of the slowdown in global economic growth, my country's PCB output value and proportion have increased year by year. From the perspective of product structure, China mainly exports mid- to low-end PCB products, while imports are mostly high-end multi-layer boards, HDI mid-to-high-end PCB products such as PCB boards, flexible boards and packaging substrates. However, as the strength of my country's PCB companies continues to increase, the product structure of the import and export of the PCB industry has gradually changed.

3. Industrial distribution of PCB industry

In the past ten years, the global share of PCB output value in America, Europe and Japan has been declining; at the same time, the global share of PCB output value in mainland China has continued to rise. According to statistics from Prismark and Huajing Industrial Research Institute, the PCB output value in mainland China in 2021 The proportion of global output value rose to 54.63 percentage points, an increase of 0.40 percentage points from the previous year. In addition, the global share of PCB output value in other Asian regions except mainland China has also slowly increased. The global PCB industry production capacity (especially high multi-layer boards, flexible High-tech PCBs such as boards and packaging substrates) are gradually concentrated in the Asian region represented by mainland China.

At present, my country has formed a PCB industry cluster with the Pearl River Delta and Yangtze River Delta regions as the core areas. In recent years, with the rise in labor costs in coastal areas, some PCB companies have begun to migrate their production capacity to areas with better basic conditions. Central and western cities, such as Hubei Huangshi, Anhui Guangde, Sichuan Suining and other places. The Pearl River Delta region and the Yangtze River Delta region are expected to maintain their dominance in the PCB industry in the future due to their talent advantages, economic advantages and supporting industrial chain advantages. leading position and continue to develop towards high-end products and high value-added products. In addition, due to the inward relocation of PCB companies in the central and western regions, they will gradually become an important industrial base for my country's PCB industry.